Week 5 — Which states are most engaged with online COVID-19 news? And who is trending up/down?

Below you’ll find the weekly update, courtesy of StatSocial’s Crisis Insights service, tracking and ranking each state based on engagement with online discussions of COVID-19.

For those new to Crisis Insights: The subscription service has been built using StatSocial’s Silhouette™ social data platform. The service is a tool for brands, marketers, and agencies seeking to understand the rapidly changing dynamics of their customers who, as a result of the uncertainty born of the COVID-19 pandemic, are finding their customer dynamics shifting during these trying times.

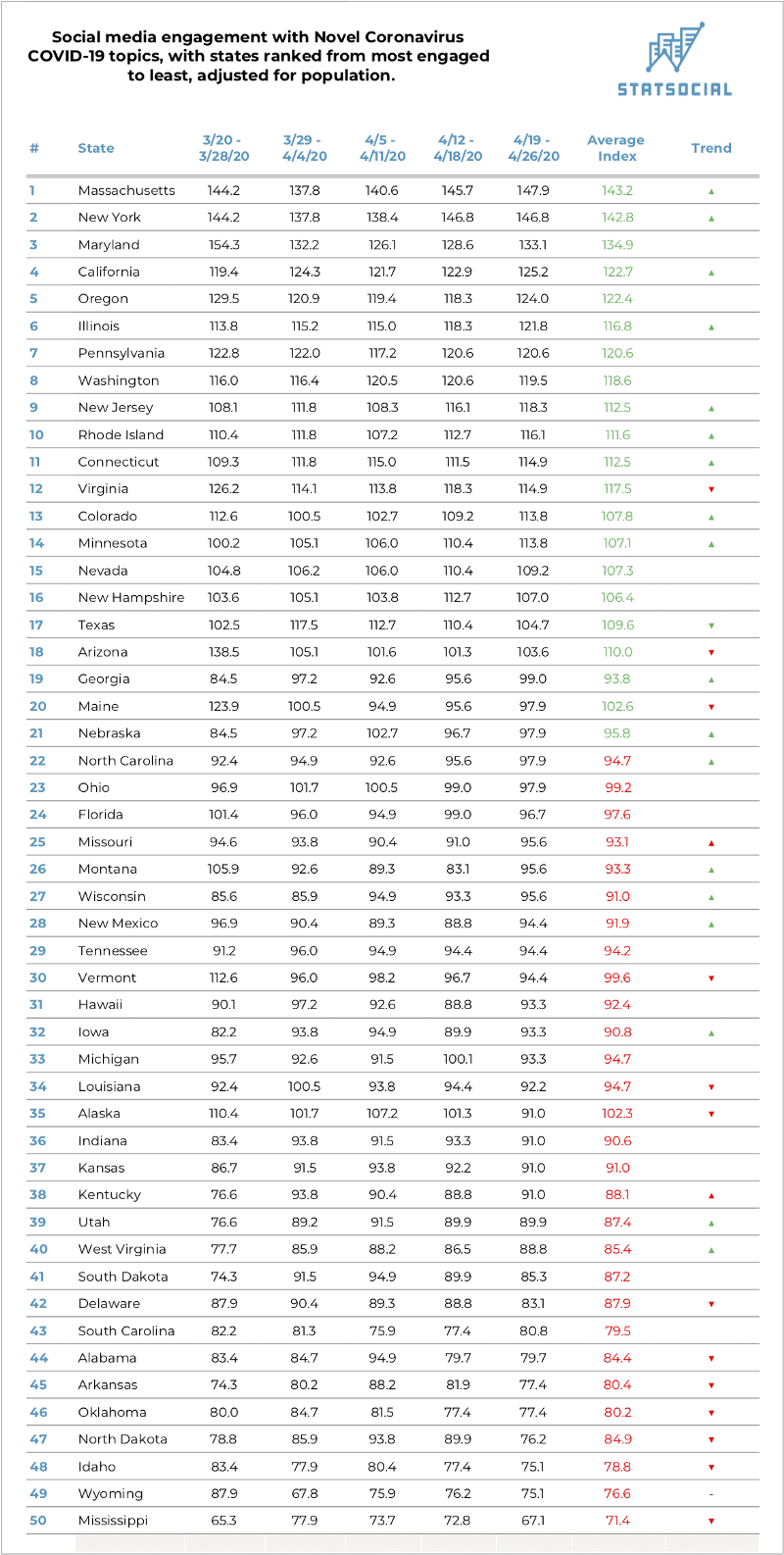

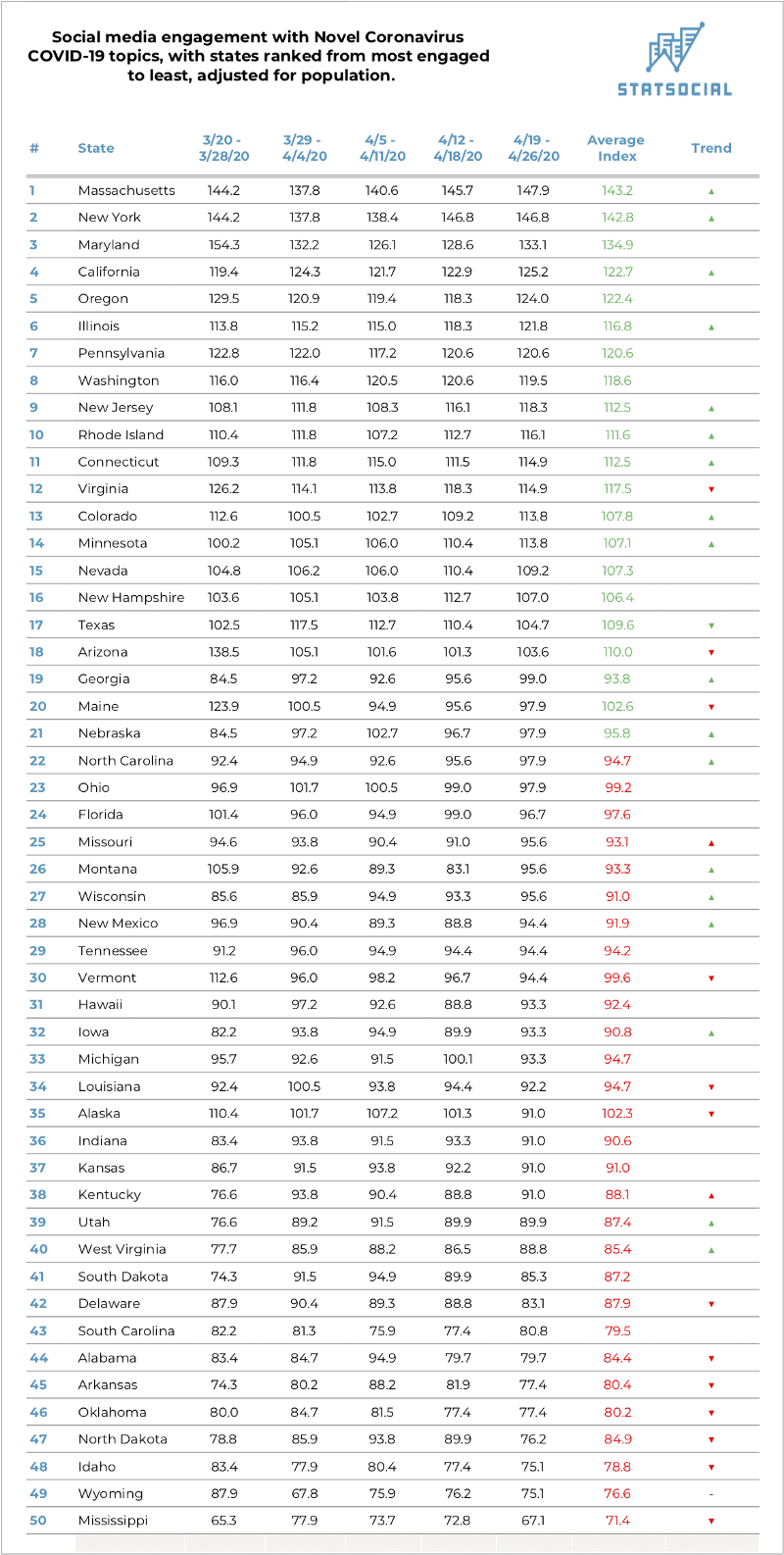

The 50 United States, ranked by online engagement with Novel Coronavirus / COVID-19 topics, from most engaged to least

Explanation of the above data: The scores on the above chart are index scores. Used for convenience here, these scores summarize, at-a-glance, the degrees to which social media content related to novel coronavirus / COVID-19 topics have been engaged with by the residents of each state.

The index scores are calculated based on contrasting the above described statistics with the entire United States population’s engagement with novel coronavirus / COVID-19 topics. A level score of 100 is used to represent this national number, and the scores on the above graphic report the degrees to which each state’s engagement is in excess of or is equal to (represented in green), or falls short of (represented in red) that baseline.

Each state’s engagement has been broken out by week (the first three to have transpired since Crisis Insights’ launch). This allows you to see how engagement has increased, decreased, or held steady week-to-week.

The data used for Crisis Insights’ reporting is collected and analyzed daily, and then reported to subscribers as rolling seven and 30-day averages (as well as a full data series).

In addition to the insights shared here — regarding where each state’s residents stand when it comes to engagement with topics surrounding the COVID-19 matter — this also offers a small glimpse into how our constantly revised, amended, and well-presented reporting allows brands to observe, compare, and retain context for customer behaviors, concerns, affinities, etc., as they shift, change, and are even replaced over the coming weeks and months.

Massachusetts, whose residents have been consistently seeking out and engaging with news, articles, and discussions pertaining to the epidemic, and the many related topics surrounding it, are currently topping the list. Engagement with novel coronavirus/COVID-19 related content has been trending upward.

The Commonwealth has had to deal with the third largest number of confirmed cases, and has endured the fourth largest number of fatalities. Just this past week, the state suffered the highest single-day death toll since the start of the outbreak. They’ve also been battling new, confirmed cases at a rate greater than any other state.

New York, which remains, by a vast margin, the hardest hit state in the country — with over 305,000 residents confirmed to have contracted the virus, and over 23,000 deaths — also finds its citizens consistently engaging with online content related to the whole matter. New Yorkers find their engagement overall trending upward.

While new hospitalizations and, even more gratefully, new deaths from the virus have been, mostly steadily, trending downward, New Yorkers are clearly making a point of remaining vigilant, and staying informed.

Maryland remains notable as engagement with content related to the crisis, at first glance, appears proportionally far larger than the degree to which the state’s residents have been hard hit. The state, though, has still been contending with an overall increasing number of new cases, finding them the third hardest hit state at this moment, in terms of trying to find success with “flattening the curve.”

Alaska, the state with the fourth smallest population in the country, had found its residents rather actively consuming and engaging with online content related to the epidemic, and the many related topics and concerns that have arisen with it. That engagement had been, however, steadily trending downward, and as of this update has really dropped off.

Also dropping off, however, is the number of confirmed cases and fatalities from the virus among Alaskans. The former number is the lowest of all states, and the latter, single-digit figure, one of the very smallest.

While Arizona experienced a slight upward tick in engagement over week 5, the overall trend has been a downward one. This has not been the case, though, with the new, confirmed cases within the state, where things have been trending upward.

The state whose residents are the least engaged with content regarding the the novel coronavirus, COVID-19, and all related matters, remains Mississippi. Notable here, because although the rate at which new cases are being confirmed remains, more or less, steady, engagement with content regarding the topic has dropped off a fair bit, and finds the overall trend a downward one.

What are Crisis Insights?

Crisis Insights provides subscribers with near real-time updates on how the unprecedented climate in which we all find ourselves is affecting consumer sentiment, both among the general public, as well as a brand’s specific customers.

Changes in consumer sentiment are tracked in this reporting, for 32 crisis-related segments, across four general categories:

- People concerned about the Covid-19 epidemic

- People concerned about the direction of the economy

- People coping and adjusting to the ‘new normal’ environment

- General attitudes and psychographic outlook of the population

With that we encourage you to continue to revisit the blog for more insights of this nature, including our weekly updates of this chart.

And most importantly, we hope that you and yours are remaining as safe and healthy as your situations allow. Please be well.

We encourage you to visit these previously shared Crisis Insights related posts:

Please note: Many of the data points featured in the below entries will have changed and evolved in the weeks since the entries were first posted (as is the way with our Crisis Insights reporting). We believe these links are still worth checking out as they illustrate more fully the nature of what kinds of statistics Crisis Insights offers, and how they can be put to use meaningfully.

The last two weeks’ updates of the above chart:

A look at the personalities of those most actively engaged with Novel Coronavirus and COVID-19 content online:

An examination of the preferred TV genres of those most active in the online COVID-19 discussion:

A look at some top-line demographic and geographic data regarding those most actively engaged in the online, COVID-19 discussion:

And here you’ll find our entry announcing and introducing Crisis Insights: