AWS vs. Azure vs. Google Cloud: What Earned Audience Data Tells Us

For this study, StatSocial executed a side-by-side-by-side analysis of the three giants of the Platform-as-a-Service/Infrastructure-as-a-Service sector: Microsoft Azure, Amazon Web Services, and Google Cloud Platform.

By analyzing the data generated by the most dedicated users of the three platforms, we can ascertain where each service’s customers’ priorities reside, and in turn where each is strongest. In this hyper-aggressive space — where these three tech behemoths are vying to be the definitive market leader, and with the needs for these services only increasing for the foreseeable future — these insights could be the key to having the competitive edge.

When gazing up at the skies on a beautiful summer’s day, the shape of the clouds will recall for different people any number of things. Maybe a puppy, or perhaps — as is the case for Linus in the comic strip featured here — the stoning of St. Stephen.

There is an objective truth about what clouds are, though; water droplets and ice crystals formed when the temperature of rising air cools below the dew point.

There is an objective truth about the clouds upon which we’ll be gazing in this entry as well. By now, you probably know the meme…

While we’re left to assume that the bit about the dew point is failing to grasp the nuance, or even the poetry, of the thing, so too is the description in the above graphic desperately wanting. Certainly, at least, if we’re discussing cloud computing’s three biggest names: Microsoft Azure, Amazon Web Services, and Google Cloud Platform.

A Quick Summary of the Market

As of this writing, Amazon leads this sector somewhat confidently. A Synergy Research Group study from 2018 reported that AWS’ market share has held steady at around 33% for 12 consecutive quarters.

AWS’ growth has continued in keeping with the cloud computing sector itself, even as said sector has tripled in size in recent years.

Comparable newcomer (at least relative to Amazon’s over ten years in the game), Microsoft Azure, has been coming up the rear, and quickly. With the vast majority of American businesses running on Microsoft software, they entered the market with a strong calling card.

Microsoft’s virtual machines are not strictly for Windows parties, however. They also support Linux, Oracle, IBM, SAP, and so on.

One perk of Azure that is oft cited is an eagerness to cater to enterprises seeking a “hybrid cloud” solution. For many companies, handing over all data and infrastructure to a public cloud — and its accompanying support — is not wise, and is often not an option. Retaining some on-premises systems is crucial for many enterprises for reasons ranging from scalability to security, and beyond.

Azure boasts support that is prepared to integrate, and cooperate, with a company’s own data center. The size of AWS being what it is, accommodating hybrid systems is not a priority, and thus far it hasn’t had to be.

Google’s entry into this area, late-arriving though it may be, has thus far found them growing quickly into their third place slot. The services they currently have on offer are not as robust and extensive as the two platforms addressed above, but what they do they do excellently, and rather affordably. Google has, to this point, not been so focused on catering specifically to enterprise demand, instead providing ground-up computing solutions for customers with needs of quite varied sizes. They do this, also, bringing to the table Google’s engineering expertise, as well as their substantial AI, analytics, and machine learning capabilities.

On Earned/Social Audience Data

A bit of an explanation of what the comparisons in this entry are about, and how we calculated them.

StatSocial’s data is culled from the earned engagement data (e.g. what people read, like, follow, share, talk about, etc.) of over 300 million consumers. Our analysis of all the content people engage with creates over 80,000 unique attributes per consumer. As a result, we provide an in-depth breakdown of an audience’s interests, affinities, media preferences, hobbies, allegiances, to which of our Digital Tribes they belong, and thanks to our partnership with IBM Watson™ and the integration of their Personality Insights™ service into our analysis, even personality types.

Our reporting reveals things that could not feasibly be learned through hundreds or, truthfully, hundreds of thousands of surveys and focus groups. StatSocial peers beyond the manicured and curated identities of social media, and digs into what really makes the various segments of any given audience tick.

While what you’ll find below may seem like a lot of data, it is only the tip of the iceberg of the insights StatSocial has on offer, regarding these (and all other) audiences. That said, we’re experts at tailoring the analysis to our users’ needs, so they’re never overwhelmed by the data.

An Explanation of the Insights Below:

The insights below are mostly sorted according to our index score. The score shows the degree to which the corresponding demographics, behaviors, and/or affinities being reported either exceed, are in line with, or fall short of the baseline. For this study, the baseline we’re using is the average American social media audience.

— — — —

DEMOGRAPHICS

The best place to start is usually at the beginning, and that’s just about where we are here.

Let’s get to know these groups of dedicated customers, first, by digging into some of the basic, fundamental stats behind each.

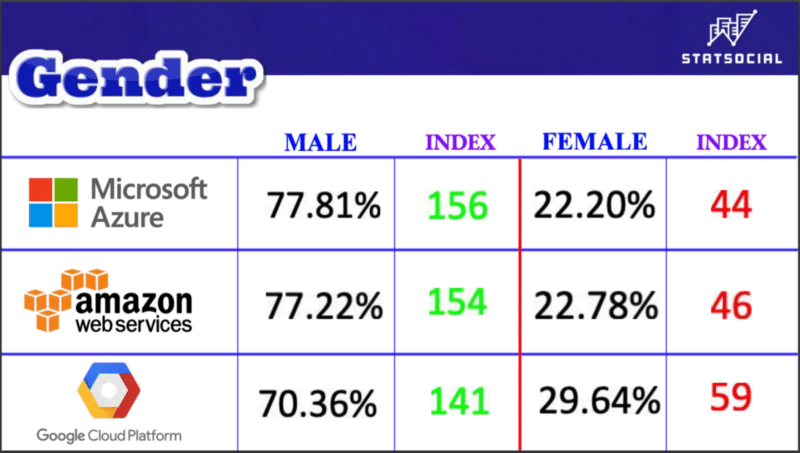

Google Cloud’s female customer-base is proportionally a fair bit larger than that of the other two platforms. All are clearly majority male, but with these being the numbers, Google does seem to be attracting more clients with women in developer, infrastructure, and database management roles.

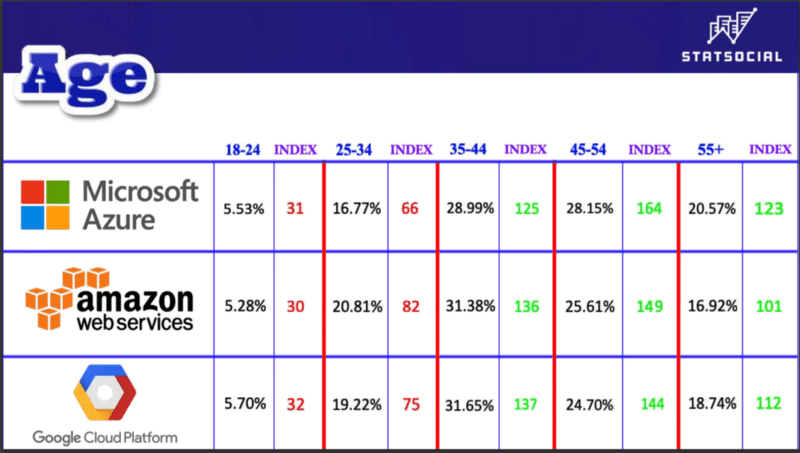

All three of these groups skew comfortably older than the average American online audience. Microsoft Azure’s customers are the most seasoned out of this bunch, with those over age 55 exceeding the baseline by nearly 1 ¼ times.

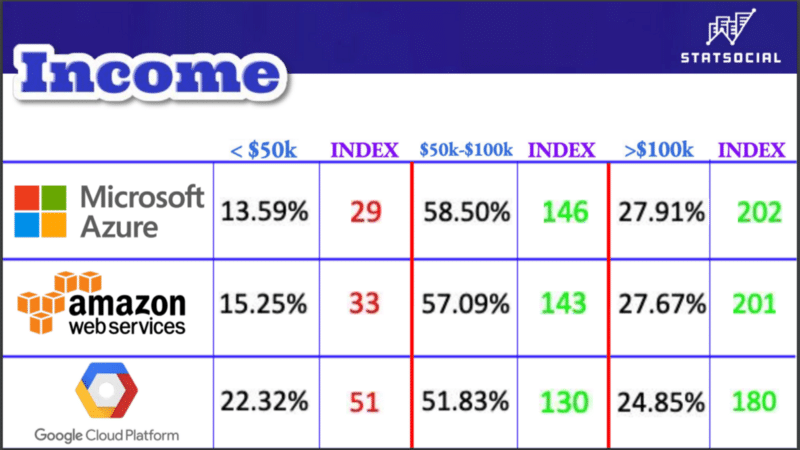

As with many StatSocial insights, a question raised by one statistic will be answered or given context by another. Even lacking that clarity here, however, it can be observed that when the lowest earning of the audiences being examined contains a nearly 77% segment earning $50k a year or more, you are looking at a bunch of well-paid audiences.

— — — —

LOCATIONS

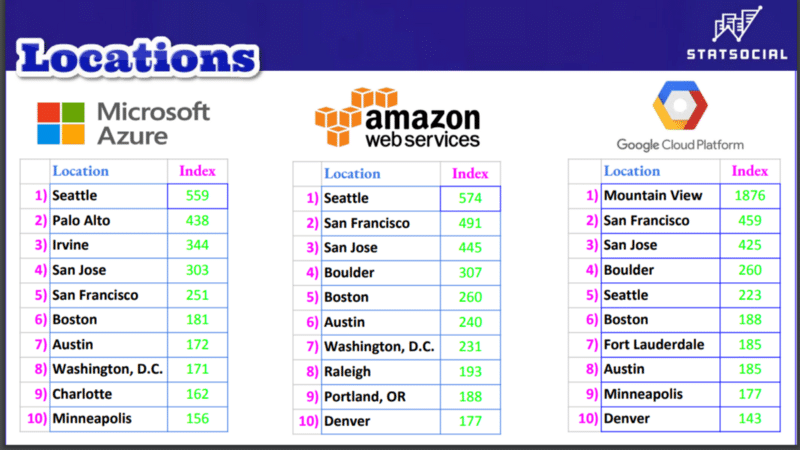

Given that the largest number of clients for these services will be centered in a handful of cities above all others, this seemed a set of data worth including.

First, the basic numbers.

The northwestern tech-hubs you’d expect are accounted for, as are those cities that are more peculiar to one of the companies over the others.

Any city that Amazon Web Services’ customers call home in large numbers, also finds Amazon’s audience as the most over-indexed of the three being looked at. This is, perhaps, most noteworthy in the case of Seattle, a town that genuinely is what it is today, to a decent degree, because of Microsoft. Fear not, though, things even out as we progress.

— — — —

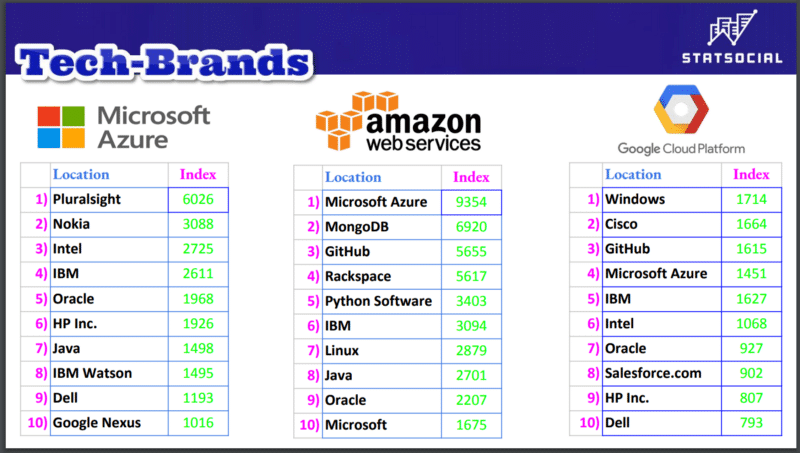

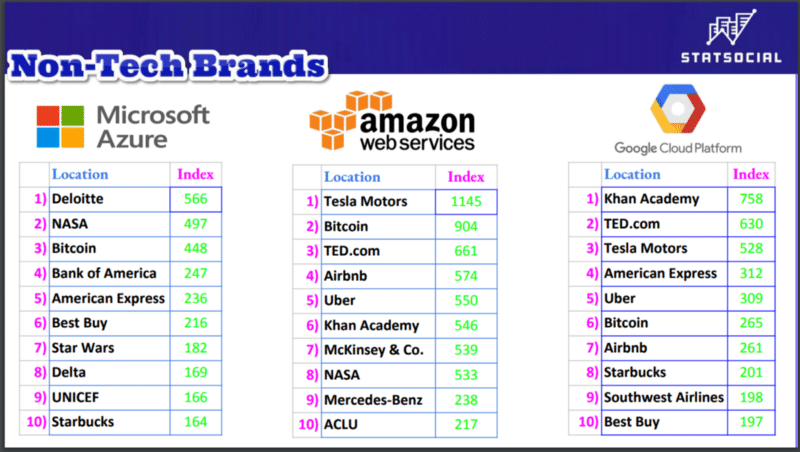

BRANDS

The extent to which tech-brands — manufacturers of computers, mobile devices, softwares, and providers of things such as, oh, say, cloud computing services — dominated these lists made it seem a wise and fair idea to include a second batch. The non-tech brands deserve their moments in the sun, do they not?

A vital thing to note about StatSocial is that, when going through our reporting, you can home in on a specific set of statistics, getting as granular as you please, or look at a more broad data-set (like, say, “brands” in general).

Let’s start with those tech brands.

Each platform was the number one brand with its own customers. As you’d expect. So, the number ones listed above are actually the number twos. But would you look at who’s atop the list of brands most popular with Amazon Web Services’ most dedicated customers? Microsoft Azure; also the number four brand among Google’s customers.

While the below lists have rather techie non-tech brands upon them, we believe where and how we made the distinctions should be rather clear.

— — — —

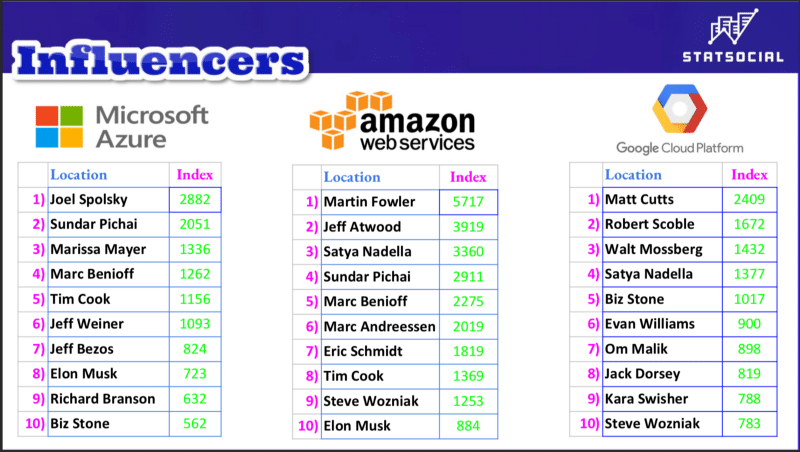

INFLUENCERS

None of us are raised in a vacuum. Wouldn’t we suffocate?

Regardless, few are the people who grow up pure and without any influence. Given what we already know to be the ages of the groups of customers under the microscope here, it’s unlikely that they grew up on any of these influencers.

They like the influencers listed below, though, and they pay attention to them. Also, a narrative established virtually from word “go” of this study is now confirmed beyond doubt, these gatherings of devoted customers are way into tech stuff.

— — — —

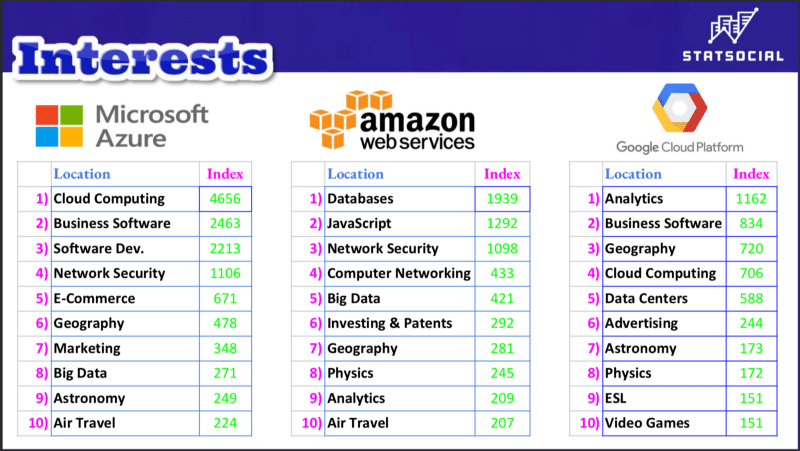

INTERESTS

While few are bereft of influence, virtually no one is entirely disinterested in all things.

The combination of interests below takes things to places that might not be entirely expected (geography, for example, which is useful, incidentally, if you’re taking things to places). But, you’ve got to confess, the below lists don’t precisely buck expectation. They do, however, illustrate that the StatSocial instruments are calibrated correctly.

We also, incidentally, can promise you that as you descend any one of these lists, more and more surprises will emerge. Hit us up for a demo, and learn precisely what types of surprises…

But wait, we’re not quite there yet.

— — — —

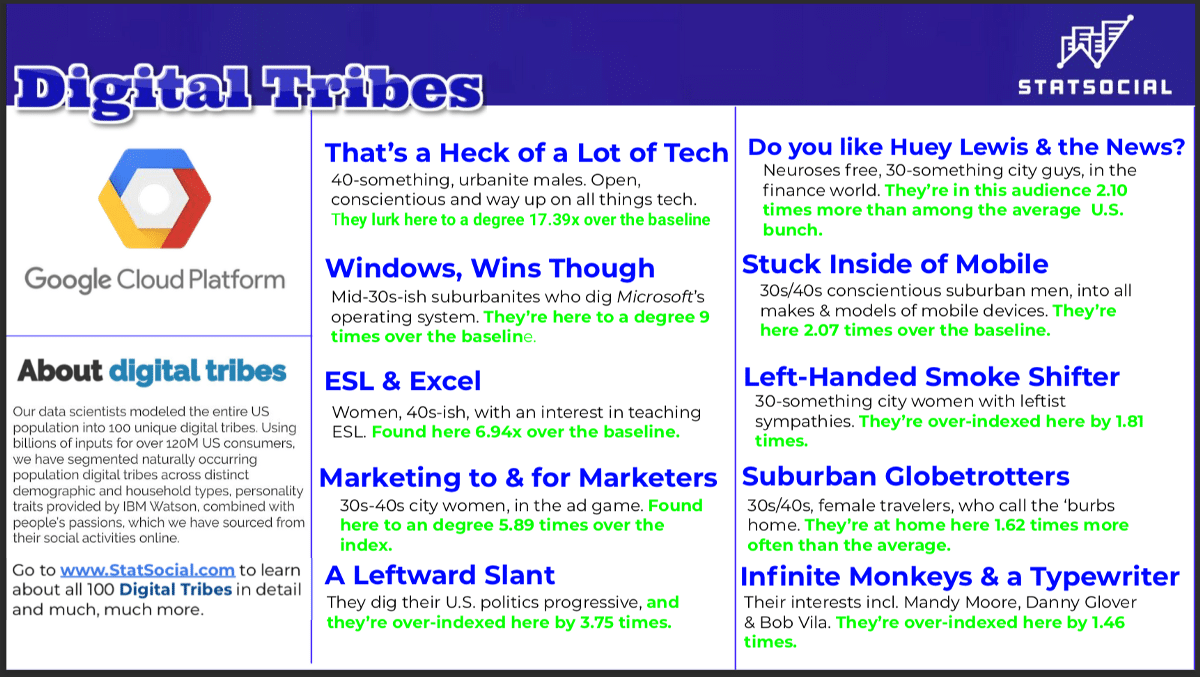

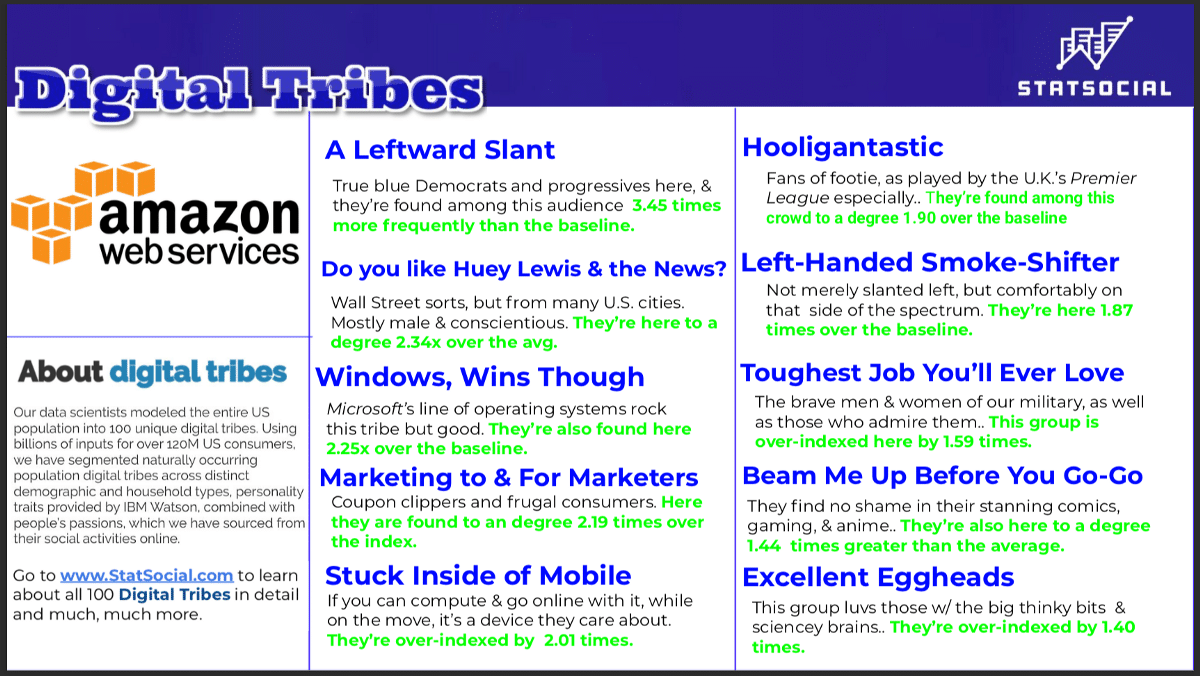

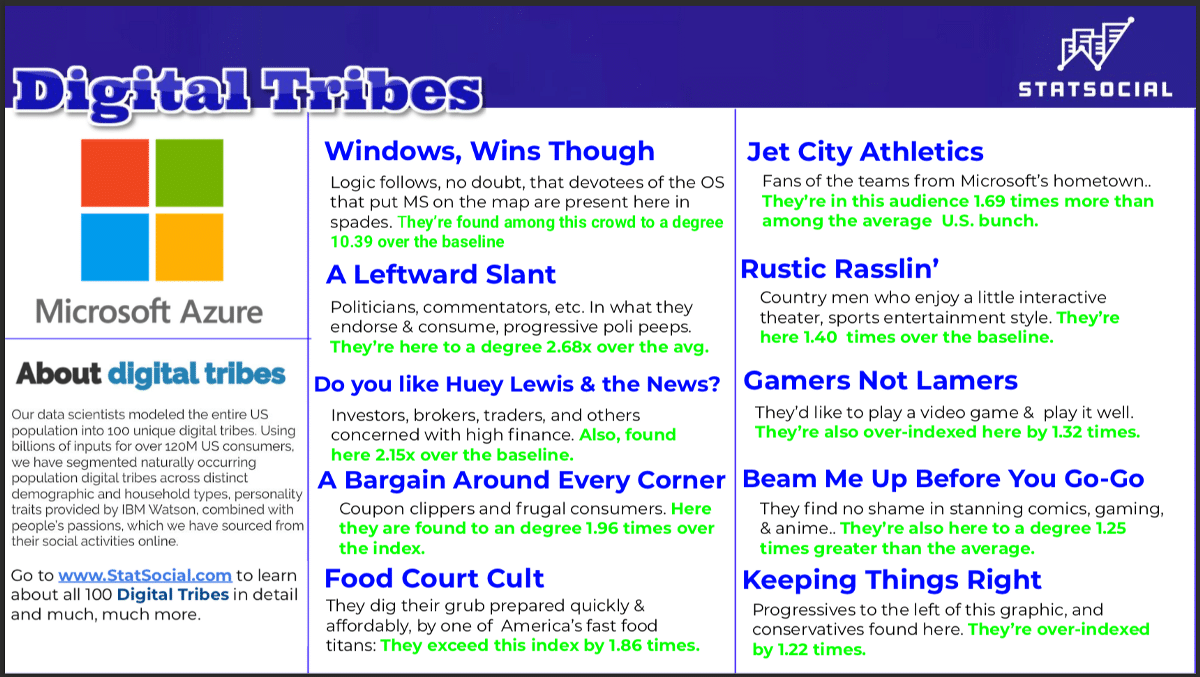

DIGITAL TRIBES

You can read a blog entry detailing this very special set of data by clicking this link, but we’ll also summarize things here.

StatSocial Digital Tribes is a model of the U.S. population broken down into 100 distinct market segments. Seeing which Tribes are present, and in what proportions, grants our users quick, crucial, and unprecedented insight into the humans who make up a given audience.

Combining our demographic and affinity data, with our Personality Insights® (powered by IBM Watson), we have been able to gather these utterly singular segmentation models. Both sides of the data coin are factored in — the demographic and the psychographic — enabling StatSocial to provide brands, publishers, media buyers, and agencies a comprehensive, in-depth understanding of their target audiences.

The three graphics below show the 10 best represented Tribes among each of the audiences being explored here. An ever-so-brief summary of the shared affinities, demographics, and/or personalities of each tribe is then provided.

More in-depth descriptions of each Tribe referenced below, and the remainder of our 100 Digital Tribes can be seen by clicking here.

— — — —

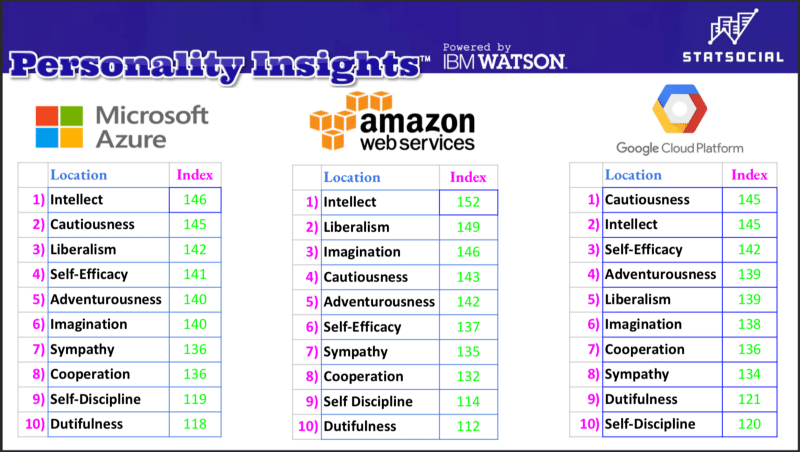

PERSONALITY INSIGHTS (powered by IBM Watson™)

As was just referenced in the Digital Tribes section…

Among the great many things StatSocial will tell you about any audience, one of the most distinctive, revealing, and essential, is a breakdown of the various personality types to be found among any audience being explored.

Thanks to StatSocial’s proud partnership with IBM Watson™ and the integration of their Personality Insights™ service into our reporting we can report on 52 unique personality traits with as much confidence as we do those metrics which to some might seem more concrete.

Visit IBM Watson’s site here to learn more about what they do.

And we’ll leave this here for now.

The broad conclusions are clear, but some more specific stories are told as well. Amazon is the war horse. The current king of the mountain. Microsoft seems to be an increasingly popular choice among those making the increasingly popular decision to pursue a hybrid cloud computing solution for their business.

Google is also growing rapidly, and is providing services a bit distinct from their two biggest competitors.

There’s a great deal more to be learned here, though (or perhaps you’d prefer to learn something directly related to another industry in which you work). Reach out to StatSocial and we’ll gladly talk to you about it.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Take a Sniff Around

Insights on top of insights can be found by the curious reader who chooses to poke around the StatSocial blog here. Peruse the many entries, offering all kinds of insights, studies, and deep dives to better acquaint you with the capabilities of StatSocial.

Throughout the blog are many examples of the sorts of insights that can only be gained with StatSocial.

— — — —

To learn more or request a demo, click here.